Our recent fund accounting buyer trends report analyzed the reasons NPOs buy nonprofit accounting software and detailed their most desired features. Stay Current with Nonprofit Buying Trends

View your yearly trends of grants and funds received in Abila MIP Fund Accounting. These types of funds grew by 18% from 2014 to 2016. Donor-advised funds (DAF) let the donor receive an immediate tax deduction and even get involved in recommending grants to the organization of your choice. Set Up Recurring Giving from DonorsĪs individuals begin to see supporting an NPO as an investment, the more these individuals will open up to recurring giving options. Araize FastFund lets you easily organize vendor invoices for audits, internal review, and tax purposes. You’ll want to ensure your business is staying compliant and up to date with the latest IRS tax regulations, including IRS Form 990 which is required by federal tax-exempt organizations. Nonprofit accounting solutions will need to help streamline your tax preparation and filing process. Some of the primary benefits offered by a nonprofit accounting software modules include: Be Better Prepared for Tax Preparation What Are The Benefits of Nonprofit Accounting Software? Sage Intacct can create numerous reports to track donations and allocations. When grants are awarded, funds can automatically be distributed to designated departments.

:max_bytes(150000):strip_icc()/Quickbooks-d1073c9ddb284953ab59c52a27f6bcd3.jpg)

Grant management: Track an application’s status from the initial submission through to acceptance.Measure and anticipate inbound donations, process recurring donations with ACH or credit card payments, corporate donations, matched gifts, individual giving and any other source of contributions to ensure accurate allocations. Donation management: Track donations and pledges from donors and fundraising campaigns.

Financial statements and reports can be exported in different formats, including CSVs, Microsoft Excel files, and PDFs, for use across departments.

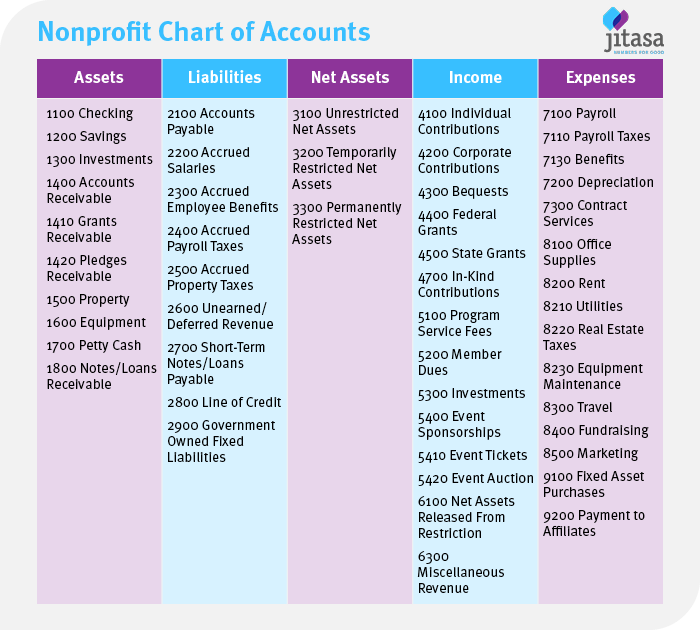

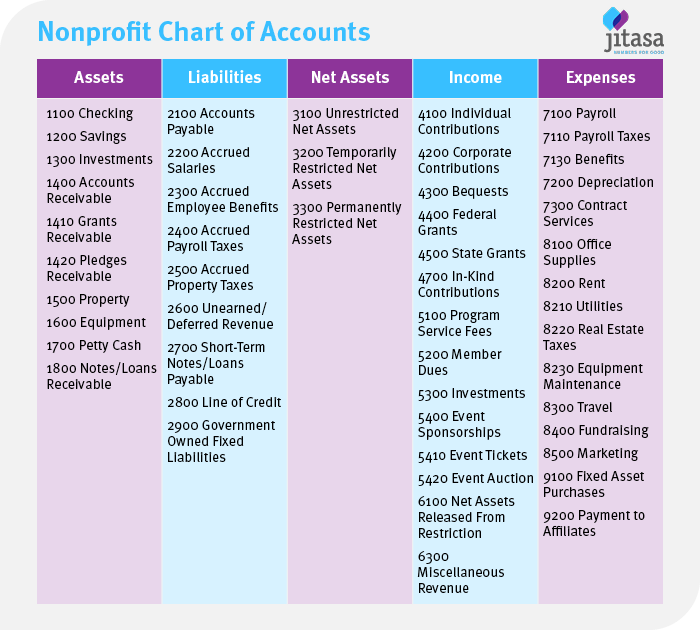

Reporting: Create earning and expense reports to fully account for an organization’s funding, complete with detailed filtering options using transaction codes. Includes automatic payment reminders, credit card payment processing, and notifications. Invoicing: Helps customers pay your organization for goods and services you’ve rendered them. Includes fund class designations, hierarchical fund management, and encumbrance management. Fund Accounting: A self-balancing set of accounting tools allowing the reservation of cash and non-cash assets for specific purposes or activities. Here’s a breakdown of the ways these functions meet the needs of an NPO: Rather than depending on a general-purpose business accounting solution with basic accounts receivable (AR) and payable (AP) functionality, organizations prefer using nonprofit accounting software for industry-specific functions, primarily fund accounting and the real-time collection of donations. Nonprofit accounting software options allow nonprofits to accurately manage the complex financial needs for organizations of any size. What Are The Features Of Nonprofit Accounting Software? View a chart of fundraising accounts in Aplos to ease financial reporting. Note: Operating a faith-based organization? A specific church accounting software may be more appropriate for your needs. This includes the financial management of online donations from crowdfunding or foreign sources, which must be reported along with an NPO’s main funding. Nonprofit accounting features enable NPOs to fully manage their sources of funding, ensuring every dollar and donor is accounted for while their accounts are accurate through proper bank reconciliation. Without meticulous recordkeeping, NPOs can be subject to audits, fines or other legal consequences. NPOs are responsible for keeping detailed records of their donations, funding sources, and earnings. A customizable solution can automatically account for and allocate funds received from grants and donations, freeing up your organization to focus on actual outreach rather than behind-the-scenes administrative tasks. This can sometimes be marketed on it’s own as fund accounting software.įor NPOs, most operating expenses are entirely made up from funds, grants, and donations. As opposed to a general-purpose accounting solution, nonprofit accounting software helps nonprofit organizations (NPOs) manage fund sources and further their organization’s mission by properly using available funds. Nonprofit accounting software is a type of nonprofit software that handles the specific financial transaction needs found within the nonprofit industry. Is QuickBooks a Nonprofit Accounting Software?. What Are The Benefits of Nonprofit Accounting Software?. What Are The Features Of Nonprofit Accounting Software?.

:max_bytes(150000):strip_icc()/Quickbooks-d1073c9ddb284953ab59c52a27f6bcd3.jpg)

0 kommentar(er)

0 kommentar(er)